Irs 1040 form software#

If you discover an error in the H&R Block tax preparation software that entitles you to a larger refund (or smaller liability), we will refund the software fees you paid to prepare that return and you may use our software to amend your return at no additional charge.

Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Emerald Cash Rewards™ are credited on a monthly basis.H&R Block is a registered trademark of HRB Innovations, Inc.All prices are subject to change without notice. H&R Block tax software and online prices are ultimately determined at the time of print or e-file.

Irs 1040 form free#

Additional terms and restrictions apply See Free In-person Audit Support for complete details. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2021 individual income tax return (federal or state).Follow step by step instructions on filing your taxes this year. Preparing your taxes on your own is simple thanks to tax software and electronic filing.

Irs 1040 form how to#

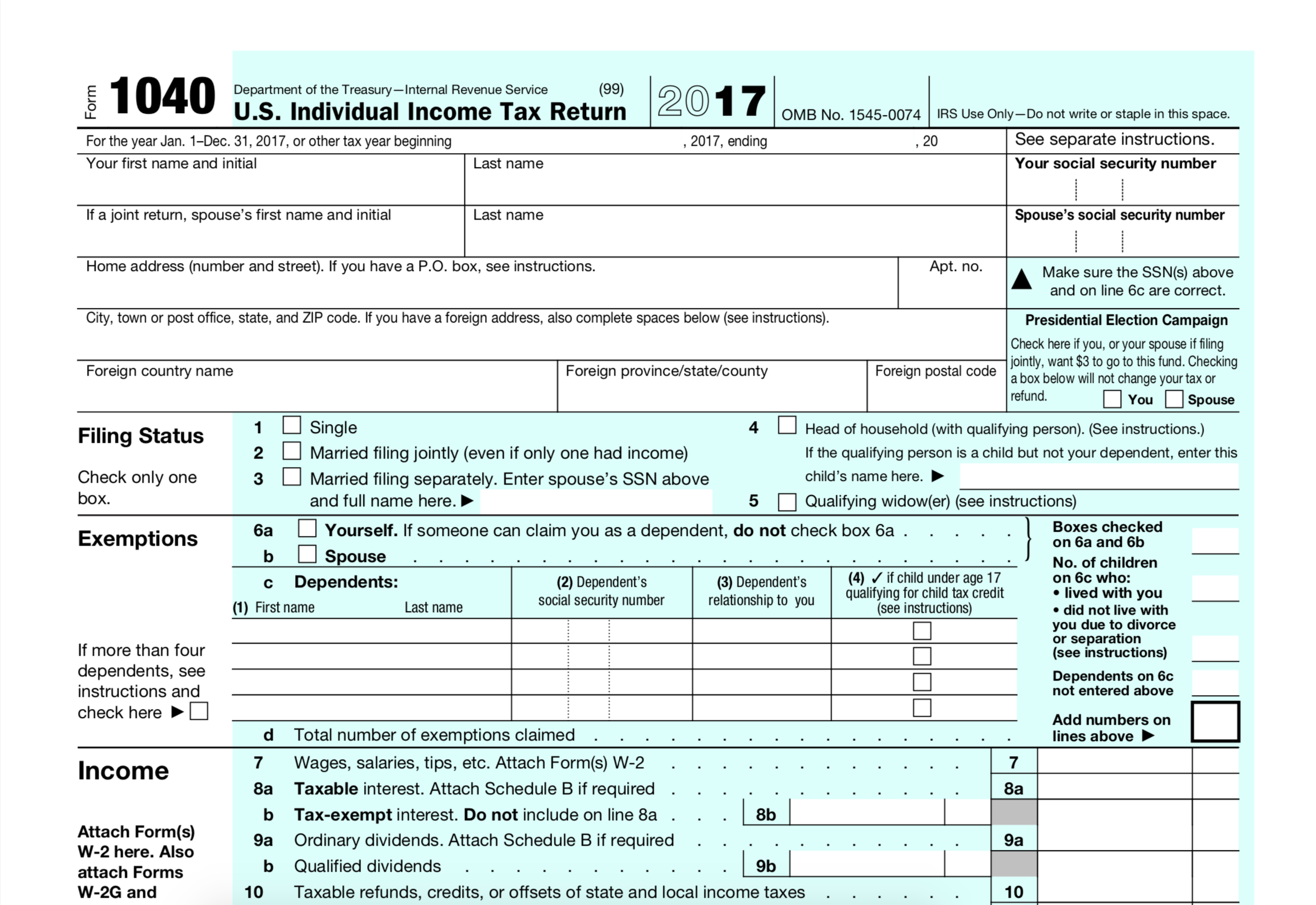

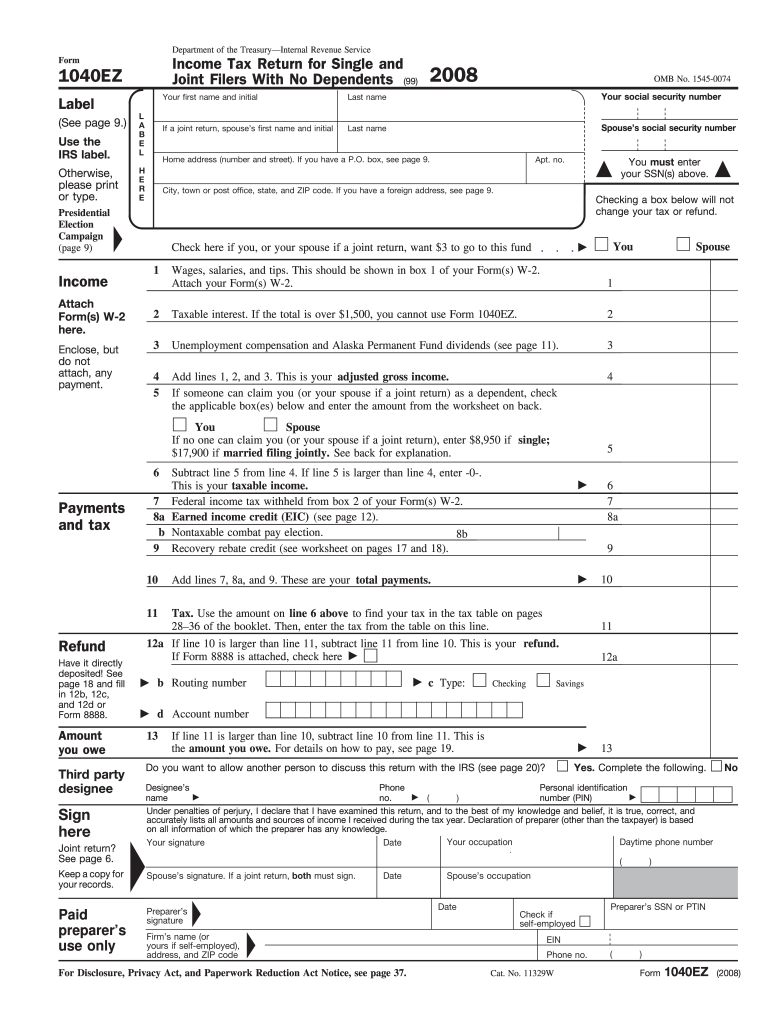

Not sure if you need to file a Form 1040 Return? Find out here: Do I need to file taxes?īelow, find the many types of 1040 forms, a brief description of each, and instructions on how to file. The 1040 is used to summarize your income and withholding as reported on various 1099 and W-2 forms. This does not include business returns on Form 1065 or 1120 (corporate, LLC, etc.) or trust returns on Form 1041. This is for individual taxpayers who earn money through employment, self-employment, retirement, interest and dividends, and other types of earned and unearned income. Simply take a short online tax interview and we will automatically prepare your respective 1040 return based on the information you provide.įorm 1040 is used for individual income tax returns who must or should file each year. When you prepare and e-file your return with, you don't have to select any forms. Read IRS Publication 519 for a detailed tax guide for aliens and information on foreign earned income. A nonresident alien is also not engaged in a trade or business in the United States and has US income on which the tax liability was not satisfied by the withholding of tax at the source. citizen or national while a nonresident alien is an alien who has not passed the green card test or the substantial presence test. However, a nonresident alien may have to use Form 1040-NR.Īn alien is a person who is not a U.S. Most United States citizens will report their information on Form 1040. Depending on your personal tax situation, there are many other forms and schedules as part of your complete tax return. An income tax return is filed or e-Filed annually, usually by April 15 of the following year of the tax year - for 2021 Returns, the due date was April 18, 2022. For example, the 20 Form 1040 added line item 30 for the Recovery Rebate Credit. The Form 1040 is the base IRS income tax form - and first page - of a Federal or IRS income tax return for a given tax year the 1040 form changes by tax year.

0 kommentar(er)

0 kommentar(er)